| |

In This Issue  |

| |

|

|

| |

Last Week in Review: Consumers are feeling confident. Find out why.

Forecast for the Week: Important news is ahead on the labor front.

View: What are you "not doing" to help your productivity? See the important tips below.

|

|

| |

|

|

| |

Last Week in Review  |

|

| |

|

|

| |

"The great thing in the world is not so much where we stand as in what direction we are moving." Oliver Wendell Holmes. Consumers are certainly feeling more confident about the direction our economy is moving. Read on for details and what they mean for home loan rates.

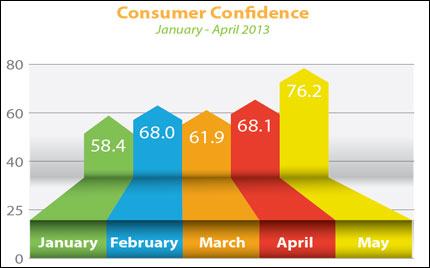

Consumer Confidence, which measures how optimistic or pessimistic consumers are with respect to the economy in the near future, hit a five-year high in May, coming in at 76.2. The Consumer Sentiment Index, a similar measure, also came in above expectations for May. Consumer Confidence, which measures how optimistic or pessimistic consumers are with respect to the economy in the near future, hit a five-year high in May, coming in at 76.2. The Consumer Sentiment Index, a similar measure, also came in above expectations for May.

There was also good news on the housing front, as the Case Shiller 20-city Home Price Index rose 10.9 percent year-over-year. This was above expectations and the best annual gain in seven years. In addition, the second estimate for first quarter Gross Domestic Product (GDP) rose by 2.4 percent. By comparison, the final reading of GDP for the fourth quarter of 2012 was 0.4 percent. GDP is an important measure of productivity growth and a key indicator of economic strength.

In inflation news, the Personal Consumption Expenditures (PCE), the Fed's favorite measure of inflation, shows that inflation remains tame. In fact, the year-over-year core PCE (which excludes volatile food and energy measurements) is running at 1.1 percent, well below the Fed's upper end target of 2 percent and just above the all-time low.

What does all of this mean for home loan rates? Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates (which are tied to Mortgage Bonds) improve. Strong economic news often has the opposite result. With several strong economic reports released last week, Bonds and home loan rates felt the impact.

However, helping Bonds and home loan rates is the fact that inflation remains non-existent, as inflation reduces the value of fixed investments like Bonds. A big question moving forward is: Will the Fed continue its Bond purchase program known as Quantitative Easing? While low inflation gives the Fed cover to do so, there are growing opinions that the program should come to an end.

The bottom line is that home loan rates remain near historic lows and now is a great time to consider a home purchase or refinance. Let me know if I can answer any questions at all for you or your clients.

|

|

| |

|

|

| |

Forecast for the Week  |

|

| |

|

|

| |

The second half of the week heats up with important news on the labor front.

- On Monday, we get data on manufacturing with the ISM Index.

- Wednesday will be a full day with Productivity, ISM Services Index and the Fed's Beige Book.

- As usual, Weekly Initial Jobless Claims will be reported Thursday. Last week, Initial Jobless Claims came in above expectation at 354,000. The data remains in a range that is consistent with just modest job growth.

- On Friday, we end the week with the often market-moving Jobs Report for May, which includes Non-Farm Payrolls and the Unemployment Rate.

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond that home loan rates are based on.

When you see these Bond prices moving higher, it means home loan rates are improving -- and when they are moving lower, home loan rates are getting worse.

To go one step further -- a red "candle" means that MBS worsened during the day, while a green "candle" means MBS improved during the day. Depending on how dramatic the changes were on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning.

As you can see in the chart below, May was a rough month for Bonds and home loan rates. But they remain near historic best levels and I will continue to monitor their movement closely.

|

|

| |

|

|

| |

The Mortgage Market Guide View...  |

|

| |

|

|

| |

|

| |

|

|

| |

Power Productivity Points

4 Things to Put On Your "Not To Do" List

"Beware the barrenness of a busy life." Socrates

Working harder isn't always the answer to expansion. Counter intuitive as it may seem, sometimes not doing things can increase your productivity and reduce your stress--a powerful combination for anyone who works just about anywhere. Creating a "Not To Do" list is essential if you want to grow your business, or show your employer you deserve that promotion.

Here are four things you can not do starting today to give you the margin you need to think and act more clearly in business and life:

Dumb uses for smartphones. If you're constantly checking Facebook, answering or originating random text messages, or have any social media account alerts turned on, you'll never be as productive as you could be.

Only check e-mail twice a day. Turn off your alerts here, too. Whenever you click on the "Get Mail" button, your brain drip feeds small doses of Something-Important-Is-About-To-Happen-Juice (psychologists call it dopamine). Except, it's not true. Try out this tip for just one week and see if you don't accomplish more than you thought possible.

Stop answering the phone. Emergencies aside, send your calls to voicemail first and return them only during set times (and state those times on your voicemail greeting). This has three instant benefits. First, it tells people you are a focused person, which they will respect and even appreciate. Second, it makes you a focused person--keeping you on task and freeing you from interruptions you can't anticipate. Third, you can determine if you're the right person to handle the call or if it can be delegated.

Just say no. There is a big difference between being busy and being productive. Want to know where you're just busy? Keep track of everything you do every 30 minutes, every day, for one week. Then take all the items that aren't moving you toward your goals and stop doing them, delegate them to someone else, or hire someone to do them for you. What will you do with all that extra time? Concentrate only on activities and processes that make money or move you ahead.

The key to more productivity is not more work. The key is more focus. Creating your "Not To Do" List will reset your priorities, refresh your morale and could even remake your career.

Make sure to pass these tips along to your clients and colleagues!

Economic Calendar for the Week of June 03 - June 07

Date |

ET |

Economic Report |

For |

Estimate |

Actual |

Prior |

Impact |

| Mon. June 03 |

10:00 |

ISM Index |

May |

50.9 |

|

50.7 |

HIGH |

| Wed. June 05 |

08:15 |

ADP National Employment Report |

May |

157K |

|

119K |

HIGH |

| Wed. June 05 |

08:30 |

Productivity |

Q1 |

0.6% |

|

0.7% |

Moderate |

| Wed. June 05 |

10:00 |

ISM Services Index |

May |

53.5 |

|

53.1 |

Moderate |

| Wed. June 05 |

02:00 |

Beige Book |

Jun |

|

|

|

Moderate |

| Thu. June 06 |

08:30 |

Jobless Claims (Initial) |

6/1 |

347K |

|

354K |

Moderate |

| Fri. June 07 |

08:30 |

Non-farm Payrolls |

May |

164K |

|

165K |

HIGH |

| Fri. June 07 |

08:30 |

Unemployment Rate |

May |

7.5 |

|

7.5 |

HIGH |

| Fri. June 07 |

08:30 |

Hourly Earnings |

May |

0.2% |

|

0.2% |

HIGH |

| Fri. June 07 |

08:30 |

Average Work Week |

May |

34.4 |

|

34.4 |

HIGH |

|

|

| |

|

|

|

|

Send to a Friend

Send to a Friend