In This Issue  |

Last Week in Review: The Fed met and the volatility continued. Find out how home loan rates were impacted.

Forecast for the Week: The last week of June will be busy, with news on housing, inflation, consumer confidence and more.

View: Been wondering what those #Hashtags are really about, and if they really do make a difference? Learn more below.

|

Last Week in Review  |

|

|

"I'm free...free fallin'." Tom Petty. Mortgage Bonds continued to fall last week as the Fed met and more volatility followed. Read on to learn what happened.

After last week's meeting of the Federal Open Market Committee (FOMC), the Fed released its Policy Statement, noting that the downside risks to the outlook for the economy and labor market have diminished. Especially important: There was no mention of tapering their Bond Purchase program known as Quantitative Easing. After last week's meeting of the Federal Open Market Committee (FOMC), the Fed released its Policy Statement, noting that the downside risks to the outlook for the economy and labor market have diminished. Especially important: There was no mention of tapering their Bond Purchase program known as Quantitative Easing.

However, in the press conference that followed, Fed Chairman Ben Bernanke said, "Assuming the economy and labor conditions evolve as the Committee expects, the Fed anticipated it would begin tapering later this year and to finish by mid-2014." This mixed message caused a sell-off in both Stocks and Bonds, adding to the volatility the markets have seen of late.

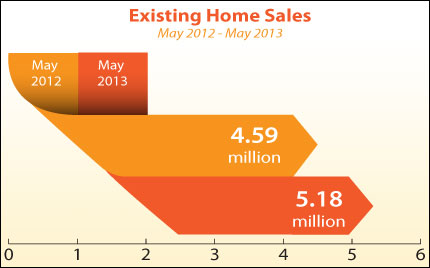

In economic reports of note, there was more good news in the housing sector as Existing Home Sales rose by 5.18 million units annualized in May. This is an increase of 12.9 percent from May 2012 and the highest rate since 5.44 million units were sold in November 2009. Housing Starts also rose by 7 percent in May, and though they came in lower than expected, they are actually up a whopping 28 percent since May 2012.

There was also some good news for the manufacturing sector, as both the Philadelphia Fed Index and the New York State Empire Manufacturing Index came in well above expectations. And inflation at the consumer level remains tame. This is good news for Bonds--and therefore home loan rates, which are tied to Mortgage Bonds--as inflation reduces the value of fixed investments like Bonds.

What does all of this mean for home loan rates?

The Fed's Bond purchase program has helped Bonds and home loan rates remain attractive. However, just the talk of potentially tapering these purchases has led to increased volatility in the markets, causing Mortgage Bonds and home loan rates to worsen recently. In addition, strong economic news has also added to the sell-off in Bonds, as investors have hoped to take advantage of gains.

The bottom line is that now remains a great time to consider a home purchase or refinance, as home loan rates remain attractive compared to historical levels. Let me know if I can answer any questions at all for you or your clients.

|

Forecast for the Week  |

|

|

Economic reports begin on Tuesday this week and the calendar is jam packed!

- The week begins and ends with how the consumer is feeling, with Tuesday's Consumer Confidence Report and Friday's Consumer Sentiment Index.

- In the housing sector, New Home Sales for May and the S&P Case-Shiller Home Price Index will be released on Tuesday, followed by Pending Home Sales for May on Thursday.

- We'll get a read on the economy with Durable Goods (orders for products lasting an extended period of time) on Tuesday and Gross Domestic Product (GDP) on Wednesday. GDP is considered the broadest measure of economic activity and is a crucial report to monitor.

- Personal Consumption Expenditures, the Fed's favorite measure of inflation, will be reported Thursday, along with Personal Income and Personal Spending.

- As usual on Thursday, Weekly Initial Jobless Claims will be released. Last week, Initial Jobless Claims rose to 354,000, coming in above expectations.

- Ending the week is news from the manufacturing sector, with Chicago PMI.

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond that home loan rates are based on.

When you see these Bond prices moving higher, it means home loan rates are improving -- and when they are moving lower, home loan rates are getting worse.

To go one step further -- a red "candle" means that MBS worsened during the day, while a green "candle" means MBS improved during the day. Depending on how dramatic the changes were on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning.

As you can see in the chart below, Mortgage Bonds worsened due to mixed messages and volatility in the markets. I'll be watching closely to see what happens this week.

|

The Mortgage Market Guide View...  |

|

|

Social Media Sizzle

6 Tips for Using Hashtags on Facebook

If you've ever wondered how to track your social media visibility and make your followers and friends able to view all your statuses on a certain topic (which generates even more buzz), then putting hashtags in your posts is the answer. A hashtag is a word or a phrase prefixed with the symbol "#" that is used to mark individual messages belonging to a particular topic in a social media status update.

Since Facebook has now jumped on the hashtag bandwagon, right behind Instagram, Pinterest, Google+, YouTube and of course Twitter (who invented the hashtag), here are a few best practices when using them:

Less is more. As with anything new, people tend to overdo it at first. Experts suggest using only two hashtags per status.

#reallylonghashtagsarehardto-read. Better to keep them short and punchy for the best impact.

Format hashtags without punctuation so they are clickable and sharable. If you want to make them even more legible in print, avoid using underscore between words #like_this. Instead, use upper and lower case #LikeThis.

Stand out from the crowd to differentiate your brand more effectively. This means you should carefully consider your target market and never be overly general when creating hashtags. Tags like #Mortgage or #RealEstate cast too wide a net and won't generate buzz for your business.

Stick them everywhere. Of course, use hashtags in your social media status updates, but to generate even more buzz try putting them on your website, in your email signature and even on printed marketing materials.

Hashtag hijackers. Beware that once you create a hashtag, it's public and anyone can use it for good or ill. If you notice one of yours is hijacked, stop using it.

Find even more great tips for using hashtags on Facebook at #HashtagTips.

And don't forget to pass these tips along to your clients and colleagues!

Economic Calendar for the Week of June 24 - June 28

Date |

ET |

Economic Report |

For |

Estimate |

Actual |

Prior |

Impact |

| Tue. June 25 |

08:30 |

Durable Goods Orders |

May |

NA |

|

3.3% |

Moderate |

| Tue. June 25 |

09:00 |

S&P/Case-Shiller Home Price Index |

Apr |

NA |

|

10.9% |

Moderate |

| Tue. June 25 |

10:00 |

Consumer Confidence |

Jun |

NA |

|

76.2 |

Moderate |

| Tue. June 25 |

10:00 |

New Home Sales |

May |

NA |

|

454K |

Moderate |

| Wed. June 26 |

08:30 |

Gross Domestic Product (GDP) |

Q1 |

NA |

|

2.4% |

Moderate |

| Wed. June 26 |

08:30 |

GDP Chain Deflator |

Q1 |

NA |

|

1.1% |

Moderate |

| Thu. June 27 |

08:30 |

Personal Spending |

May |

NA |

|

0.2% |

Moderate |

| Thu. June 27 |

08:30 |

Personal Income |

May |

NA |

|

0.0% |

Moderate |

| Thu. June 27 |

08:30 |

Jobless Claims (Initial) |

6/22 |

NA |

|

NA |

Moderate |

| Thu. June 27 |

08:30 |

Personal Consumption Expenditures and Core PCE |

May |

NA |

|

0.0% |

HIGH |

| Thu. June 27 |

10:00 |

Pending Home Sales |

May |

NA |

|

0.3% |

Moderate |

| Fri. June 28 |

09:45 |

Chicago PMI |

Jun |

NA |

|

58.7 |

Moderate |

| Fri. June 28 |

10:00 |

Consumer Sentiment Index (UoM) |

Jun |

NA |

|

82.7 |

Moderate |

|

|

|

|

Send to a Friend

Send to a Friend