|

Follow Me On: |

|

Kathleen Petty AVP/Sr Mortgage Originator Global Credit Union Home Loans AK#157293 Phone: (907)261-3458 Cell: 223-4440 Fax: (907)929-6699 License: NMLS Unique Identifier #203077 K.Petty@gcuhome.com https://www.globalcu.org/home-loans/resources/originators/Kathleen-Petty/ |

| ||

| ||||

April 2008

|

Does the Fed Change Your Monthly Mortgage Payment?

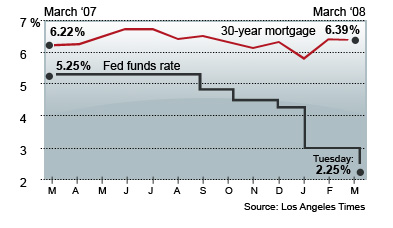

The Federal Reserve has cut interest rates six straight times since September 2007. Most analysts are predicting that the Fed will cut rates even further when it meets at the end of this month. And yet, despite a full 3% in interest rate cuts during this time, mortgage rates are significantly higher now than they were just three months ago. How is that possible? Don't rate cuts equal lower mortgage rates? Read on as the team at YOU Magazine goes behind the headlines to show you how these Fed cuts do and don't affect your mortgage. Here's the straight story: Mortgage interest rates are dictated by one thing and one thing only — the performance of mortgage-backed securities. Despite what you may have heard in the media, interest rate cuts from the Federal Reserve have no direct effect on long-term mortgage rates. The True Role of the Federal Reserve But, to control inflation, the Fed has several tools at its disposal, including the ability to adjust the Discount Rate and the Fed Funds Rate, which are very different from mortgage interest rates. By increasing or decreasing these interest rates, the Fed can manage inflation and economic growth according to its financial policy. While movement in these interest rates does affect the Prime Interest Rate – which directly affect things like credit cards, home equity lines of credit (HELOCs), and adjustable-rate mortgages – long-term mortgage rates do not always follow suit. In the following chart, mortgage rates are shown to have actually increased from March 2007 to March 2008, even though the Federal Reserve cut interests rates six consecutive times, slashing three full percentage points in the process.

What Really Moves Mortgage Rates? Without getting too technical, MBS are bonds that represent mortgages currently in place. For instance, let's say you have a 30-year fixed rate mortgage of $200,000 at an interest rate of 6%. That loan isn't worth anything right now, but over a 30-year period, it represents a profit of 6% or up to $12,000 every year for the bank that owns the loan, provided you make all of your payments. However, instead of waiting 30 years to collect on that profit, your loan is "sold" to a bank where it is bundled together with other similar loans. It's like winning the lottery and choosing the cash value prize instead of accepting full payments that are spread over 20 years. Of course, you get less money than the total value of the prize if you choose the cash upfront, but you don't have to wait twenty years to collect it all. This group of bundled loans then, just like a public company, is split into smaller units or bonds and sold just like stocks in a company to investors. These bonds, secured or backed by the profits from the loans, are called mortgage-backed securities. And just like stocks, investors like you and me can buy and sell them every day. And it's the performance of these specific bonds that lending institutions use to set mortgage rates. The real dynamic at the heart of interest rate movement, then, is the complex relationship between stocks and bonds, supply and demand, inflation, news that moves markets, the economy, employment levels, political events, gross domestic product, and any number of other factors. And while there exist a number of somewhat reliable economic indicators, if anyone tells you that he or she has the secret formula for predicting these movements exactly, it's just not true. There is no magic formula, no index, no rate cuts or Fed activities that work 100% of the time. The best you can hope for is an experienced mortgage professional who truly understands mortgage-backed securities and how they trade. He or she can utilize specific market knowledge and experience to take advantage of daily fluctuations and lock in a rate that could save you thousands of dollars throughout the life of your loan. If you're waiting for the Federal Reserve – or worse, the media – to create refinance or new home buying opportunities for you, don't count on it. Call an experienced mortgage professional and get the facts. | ||||||||||||||||||||||||||||||

License #AK157293 You are receiving a complimentary subscription to YOU Magazine as a result of your ongoing business relationship with Kathleen Petty. While beneficial to a wide audience, this information is also commercial in nature and it may contain advertising materials. INVITE A FRIEND to receive YOU Magazine. Please feel free to invite your friends and colleagues to subscribe. SUBSCRIBE to YOU Magazine. If you received this message from a friend, you can subscribe online. UNSUBSCRIBE: If you would like to stop receiving emails from Kathleen Petty, you can easily unsubscribe. Global Credit Union Home Loans AK#157293 |

, 125 W Dimond Blvd #110 Anchorage, AK 99515 Powered by Platinum Marketing © Copyright 2024. Vantage Production, LLC. | |||||||||